Last year was one of recovery for Carnival Corp. (NYSE: CCL)(NYSE: CUK). The cruise line operator benefited from a resurgence in travel as it posted record numbers. Shares of the company rose by 130% last year as a result.

But will that remain the case in 2024? Although business has been good, Carnival Corp. is carrying an awful lot of debt. And the key to bringing it down this year is generating ample free cash flow. If the company does that, it could result in another strong year for the travel stock.

Why free cash flow will be important to Carnival Corp.

Free cash flow is a company's operating cash flow after deducting capital expenditures. It tells investors how much cash the company has available to reinvest in its operations for further growth, pay dividends, or pay down debt. It's arguably just as important, if not more so, than accounting profits, which factor in noncash expenses.

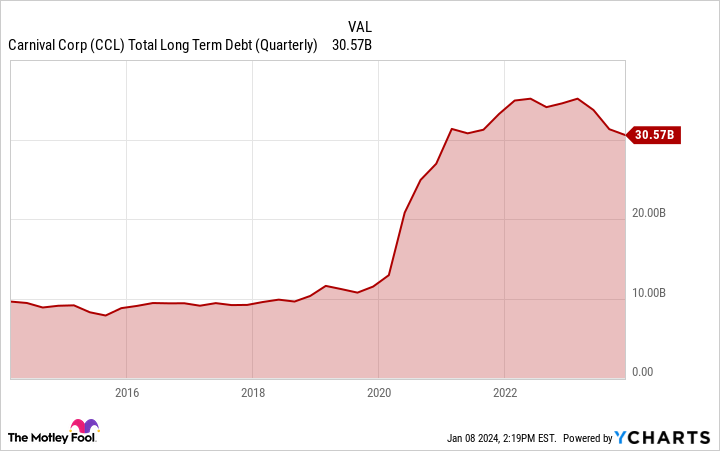

During the early stages of the pandemic and amid travel restrictions, cruise ship companies struggled, and Carnival was no exception. As a result of the challenging economic conditions, Carnival had to resort to taking on additional debt, and it now carries significantly more of it than it needed to in the past.

The above chart suggests there's a mountain of debt for Carnival Corp. to pay down, which it has begun. But a key metric in determining how quickly the cruise operator will be able to do so is free cash flow; the more cash that it has available to put to use, the quicker it can extinguish some of that debt. As of Nov. 30, 2023, the company's current and long-term debt totaled $30.6 billion -- down from $34.5 billion a year earlier.

Although the company has been making progress, Carnival's high debt load is likely a key reason investors aren't more bullish on the stock; Carnival's shares were trading higher than $40 before the pandemic, while today, they struggle to hit the $20 mark.

Free cash flow is back to pre-pandemic levels

One thing that is back to pre-pandemic levels for Carnival Corp. is its free cash flow. In the fiscal year ending Nov. 30, 2023, the company reported $21.6 billion in revenue, which was an increase of 77% from a year earlier. The company also reported an operating profit of just under $2 billion versus a loss of $4.4 billion in the previous year. The stronger results have also translated into much stronger free cash flow for Carnival.

But Carnival Corp. isn't content with the status quo. CFO David Bernstein said in the company's fiscal full-year 2023 earnings release, "We expect durable revenue growth to drive increases in adjusted free cash flow in 2024 and beyond, which will be the primary driver for paying down our debt balances on our path back to investment grade." Bernstein also said the company is going to look for opportunities to refinance debt, which could arise if interest rates come down this year.

Is Carnival Corp. stock a buy?

Carnival Corp.'s business has been performing well now that the cloud of travel restrictions is gone. And with management focusing on reducing its debt, the company's financials should continue to improve this year.

While Carnival did have a strong year in 2023, the stock still looks poised for more growth; investors appear to still be doubting the strength of the company's performance and its ability to do well given its high debt load.

Although the company's debt is not a risk investors should ignore, as long as Carnival's free cash flow remains strong this year, the travel stock should do well.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Carnival Corp. wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

This Could Make or Break Carnival Corp.'s Year in 2024 was originally published by The Motley Fool

"corp" - Google News

January 11, 2024 at 09:17PM

https://ift.tt/dJAYSxX

This Could Make or Break Carnival Corp.'s Year in 2024 - Yahoo Finance

"corp" - Google News

https://ift.tt/T5xFhJw

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "This Could Make or Break Carnival Corp.'s Year in 2024 - Yahoo Finance"

Post a Comment