In a notable insider transaction, CFO Kevin Hettrich of QuantumScape Corp (NYSE:QS) sold 45,981 shares of the company on November 20, 2023. This sale is part of a series of transactions by Hettrich over the past year, which has seen the insider selling a total of 399,212 shares and making no purchases. The recent sale by the insider has sparked interest among investors and analysts, prompting a closer look at the implications of such insider activity on the stock's performance and valuation.

Who is Kevin Hettrich?

Kevin Hettrich serves as the Chief Financial Officer of QuantumScape Corp, a role that places him in charge of the company's financial operations, including strategic planning, risk management, and financial reporting. Hettrich's position gives him an intimate understanding of the company's financial health and prospects, making his trading activities particularly noteworthy to investors seeking insights into the company's performance.

QuantumScape Corp's Business Description

QuantumScape Corp is a leader in the development of solid-state lithium-metal batteries for use in electric vehicles (EVs). The company's groundbreaking technology aims to provide higher energy density, faster charging times, and improved safety compared to traditional lithium-ion batteries. QuantumScape's innovations have the potential to accelerate the adoption of EVs by addressing some of the key limitations of current battery technology.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable clues about a company's future prospects. When insiders buy shares, it is often interpreted as a sign of confidence in the company's growth potential. Conversely, insider selling can sometimes raise concerns about the company's future performance or valuation. However, it is important to note that insiders may sell shares for various reasons, such as diversifying their investment portfolio or personal financial planning, which may not necessarily reflect their outlook on the company's future.

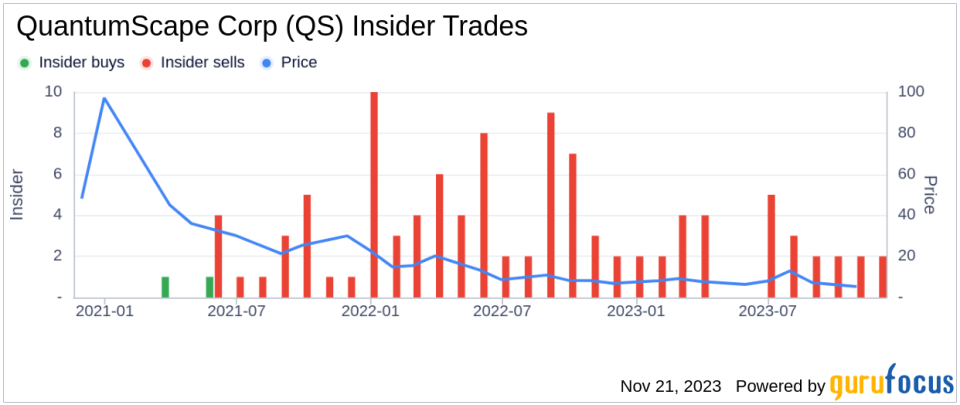

In the case of QuantumScape Corp, the absence of insider purchases over the past year, coupled with 28 insider sells, could suggest that insiders are cautious about the company's short-term growth prospects or believe the stock may be overvalued at current levels. However, without additional context, it is difficult to draw definitive conclusions from this activity alone.

On the day of Hettrich's recent sale, QuantumScape Corp shares were trading at $6.08, giving the company a market cap of $2.957 billion. This valuation reflects the market's current assessment of the company's potential to capitalize on the growing demand for advanced battery technologies in the EV market.

The relationship between insider selling and stock price can be complex. While a series of sales by insiders may lead to negative sentiment among investors, it is also possible for a stock to maintain or even increase its value if the company's fundamentals remain strong and the broader market outlook is positive. Therefore, investors should consider insider trading activity as one of many factors in their investment decision-making process.

The insider trend image above provides a visual representation of the insider trading activity at QuantumScape Corp. The absence of insider buys and the prevalence of insider sells over the past year are clearly depicted, which may raise questions among investors about the insiders' collective view of the company's valuation and future prospects.

Conclusion

Kevin Hettrich's recent sale of 45,981 shares of QuantumScape Corp is a significant insider transaction that warrants attention. While the reasons behind the insider's decision to sell are not publicly known, the pattern of insider selling over the past year could be a signal for investors to closely monitor the company's performance and market trends. As with any investment decision, it is crucial to consider a wide range of factors, including insider trading activity, company fundamentals, industry developments, and macroeconomic conditions, before drawing conclusions about the potential impact on the stock's future price movements.

Investors and analysts will continue to watch QuantumScape Corp's stock performance and insider trading activity to gauge the confidence level of those with the most intimate knowledge of the company. As the EV market evolves and QuantumScape Corp strives to commercialize its solid-state battery technology, the actions of insiders like CFO Kevin Hettrich will remain a point of interest for those looking to understand the inner workings of this innovative company.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

"corp" - Google News

November 21, 2023 at 09:03PM

https://ift.tt/0xqJRAi

QuantumScape Corp CFO Kevin Hettrich Sells 45,981 Shares - Yahoo Finance

"corp" - Google News

https://ift.tt/Z8adLEg

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "QuantumScape Corp CFO Kevin Hettrich Sells 45,981 Shares - Yahoo Finance"

Post a Comment