Assessing the Sustainability and Growth of Bank of America's Dividends

Bank of America Corp (NYSE:BAC) recently announced a dividend of $0.24 per share, payable on 2023-12-29, with the ex-dividend date set for 2023-11-30. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Bank of America Corp's dividend performance and assess its sustainability.

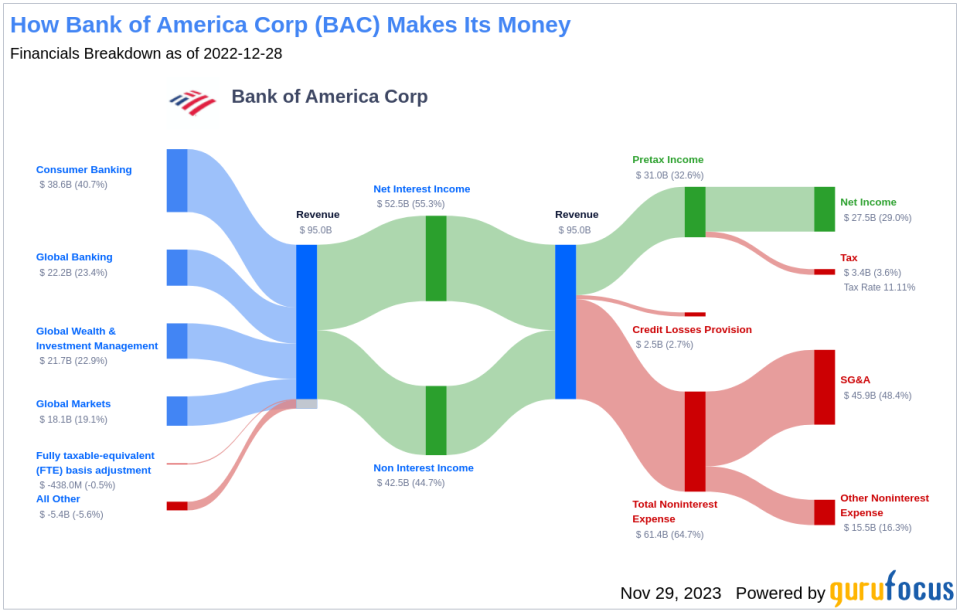

What Does Bank of America Corp Do?

Bank of America is one of the largest financial institutions in the United States, boasting over $2.5 trillion in assets. It operates across four main segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America's consumer banking arm encompasses its branches, lending services, and small-business solutions, while its Merrill Lynch and private bank divisions offer brokerage and wealth-management services. The company's wholesale operations include investment banking and capital markets activities. With a strong U.S. focus, Bank of America also has a significant international presence.

A Glimpse at Bank of America Corp's Dividend History

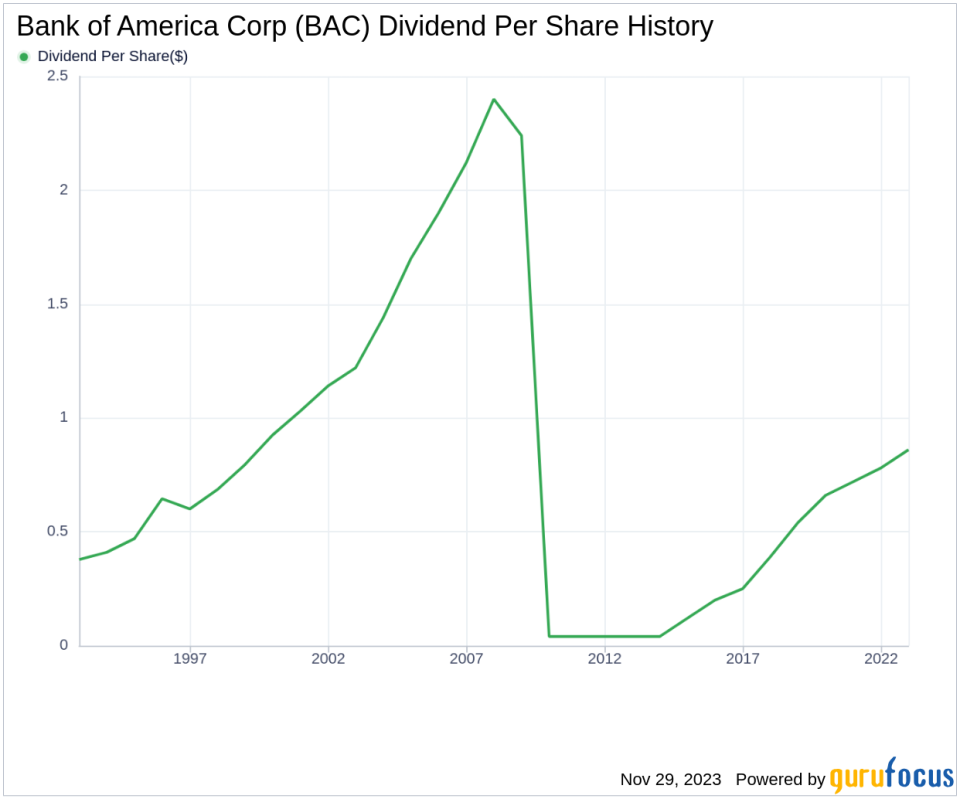

Since 1986, Bank of America Corp has upheld a steady track record of dividend payments, with quarterly distributions to shareholders. The company has demonstrated a commitment to increasing dividends annually since 2009, earning the status of a dividend achiever. This distinction is reserved for companies that have consistently raised their dividends for at least 14 consecutive years.

For a visual representation of this trend, here is a chart illustrating the annual Dividends Per Share over time.

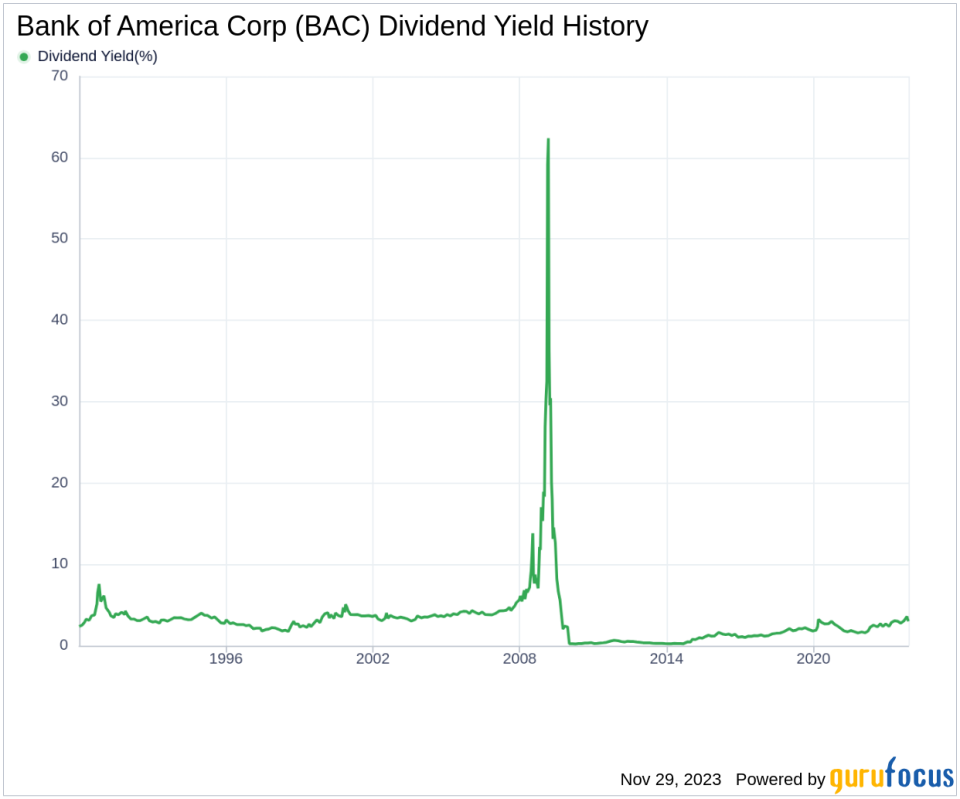

Breaking Down Bank of America Corp's Dividend Yield and Growth

Bank of America Corp boasts a 12-month trailing dividend yield of 3.04% and a forward dividend yield of 3.25%, indicating anticipated dividend increases in the coming year. In the past three years, the dividend growth rate was 9.20%, which expanded to 15.80% annually over five years. Over the last decade, the annual dividends per share growth rate impressively hit 38.40%. Reflecting on yield and growth, the 5-year yield on cost for Bank of America Corp stock is approximately 6.33%.

The Sustainability Question: Payout Ratio and Profitability

A key indicator of dividend sustainability is the payout ratio, which shows what portion of earnings is returned to shareholders as dividends. Bank of America Corp's dividend payout ratio is currently at 0.25, suggesting a balanced approach between distributing profits and retaining earnings for growth. The company's profitability rank is 6 out of 10, indicating fair profitability. With a consistent record of positive net income over the past ten years, Bank of America Corp's financial health appears robust.

Growth Metrics: The Future Outlook

Bank of America Corp's growth rank stands at 6 out of 10, pointing to a fair growth outlook. The company's revenue per share and 3-year revenue growth rate, at 6.40% annually, surpasses 51.49% of global competitors. Furthermore, the 3-year EPS growth rate of 5.10% annually outperforms 37.58% of global peers. Lastly, the 5-year EBITDA growth rate of 12.50% outshines 64.91% of competitors, showcasing Bank of America Corp's potential for sustained growth and dividends.

Engaging Conclusion: Bank of America Corp's Dividend Outlook

For value investors, Bank of America Corp presents a compelling case with its reliable dividend history, robust yield, and consistent growth. The company's prudent payout ratio and solid profitability underscore the sustainability of its dividends. Coupled with promising growth metrics, Bank of America Corp stands out as a potentially attractive investment for those seeking steady income and long-term value. As the financial landscape evolves, how will Bank of America Corp adapt to maintain its dividend attractiveness? Will its strategic initiatives align with the dynamic market demands? These are questions investors may ponder as they consider the bank's role in their portfolios.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

"corp" - Google News

November 29, 2023 at 05:05PM

https://ift.tt/xIdgnW7

Bank of America Corp's Dividend Analysis - Yahoo Finance

"corp" - Google News

https://ift.tt/m46nGPw

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Bank of America Corp's Dividend Analysis - Yahoo Finance"

Post a Comment