In a notable insider transaction, Director Dawn Hudson sold 11,000 shares of NVIDIA Corp (NASDAQ:NVDA) on November 28, 2023. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Dawn Hudson of NVIDIA Corp?

Dawn Hudson is a respected figure in the corporate world, known for her strategic insight and leadership skills. At NVIDIA Corp, she serves as a member of the board of directors, bringing her extensive experience to the table. Hudson's background includes high-profile roles such as the former CEO of Pepsi-Cola North America and the former President and CEO of the National Football League's marketing arm. Her expertise in marketing and brand strategy is an asset to NVIDIA, a company that operates in the highly competitive tech industry.

NVIDIA Corp's Business Description

NVIDIA Corp is a global leader in the design and manufacture of graphics processing units (GPUs) and related technologies. The company's products are essential for a range of applications, from gaming and entertainment to professional visualization, data centers, and artificial intelligence. NVIDIA's innovative approach to parallel computing has also positioned it at the forefront of the burgeoning field of AI, making it a key player in an industry that is shaping the future of technology.

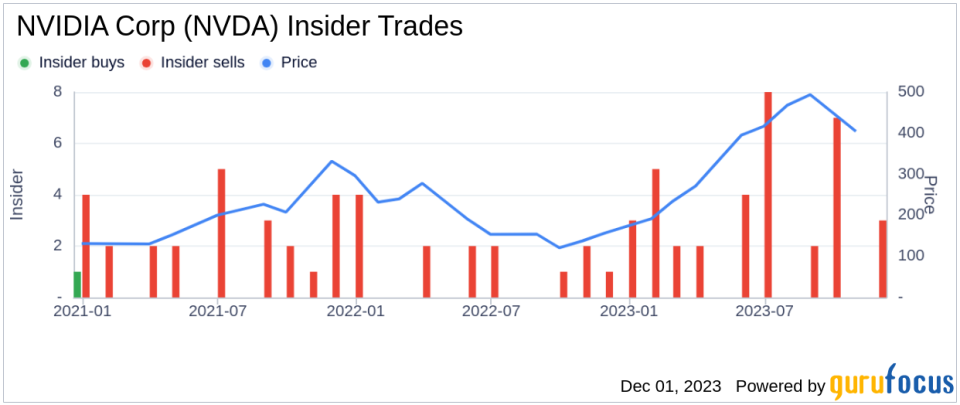

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly sales, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future prospects, it is important to consider the context. Insiders might sell shares for personal financial planning, diversification, or other non-company related reasons. In the case of Dawn Hudson, the insider has sold 27,000 shares over the past year without purchasing any shares. This pattern of behavior could suggest that the insider is taking profits or reallocating assets rather than reflecting a negative outlook on NVIDIA's future.

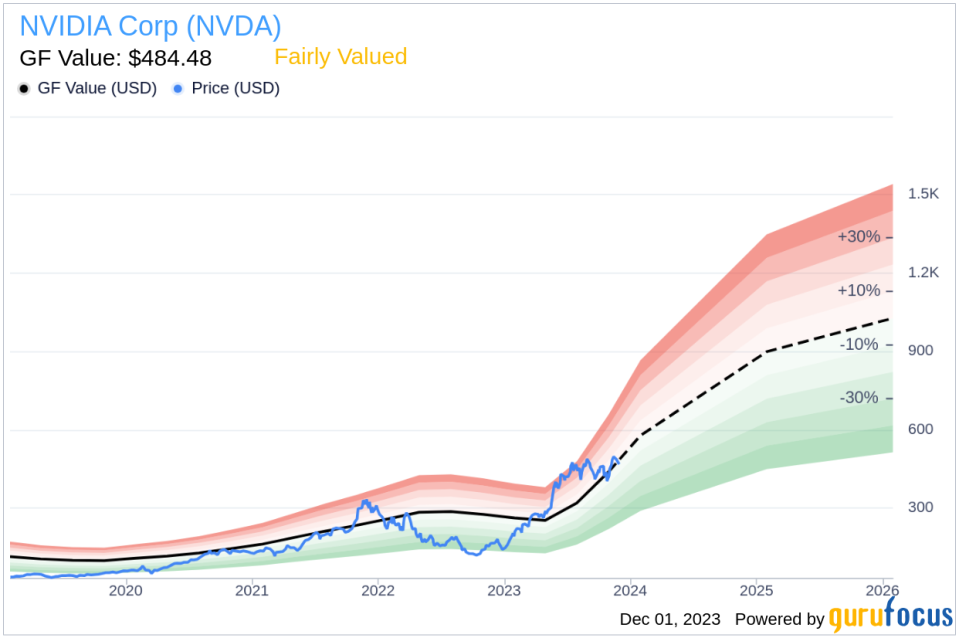

On the day of the insider's recent sale, NVIDIA Corp shares were trading at $477.77, giving the company a substantial market cap of $1,155,243.7 million. The price-earnings ratio of 61.70 is higher than both the industry median of 26.49 and NVIDIA's historical median, indicating that the stock is priced at a premium compared to its peers and its own past valuation.

However, with a price-to-GF-Value ratio of 0.99, the stock appears to be Fairly Valued according to the GF Value, which suggests that the current price is in line with the intrinsic value estimated by GuruFocus. This valuation takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above shows the pattern of insider transactions over the past year. With no insider buys and 37 insider sells, there seems to be a general trend of insiders taking profits off the table. This could be a signal to investors to watch the stock closely for any changes in fundamentals that might justify this selling activity.

The GF Value image provides a visual representation of NVIDIA's stock price in relation to its intrinsic value. The close alignment of the current price with the GF Value indicates that the market is pricing the stock in a way that reflects its estimated true worth, based on the factors mentioned earlier.

Conclusion

Director Dawn Hudson's recent sale of 11,000 NVIDIA shares may raise questions among investors, but it is crucial to consider the broader context. While the insider has been selling shares over the past year, NVIDIA's stock is currently deemed Fairly Valued, and the company holds a strong position in the tech industry with its innovative products and strategic focus on AI. Investors should continue to monitor insider activity and company performance for further insights, but as of now, NVIDIA's market position and valuation suggest a stable outlook.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock. Investors should conduct their own research, considering a company's financial health, market trends, and other relevant factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

"corp" - Google News

December 01, 2023 at 01:04PM

https://ift.tt/7aHILMF

Insider Sell: Director Dawn Hudson Sells 11,000 Shares of NVIDIA Corp (NVDA) - Yahoo Finance

"corp" - Google News

https://ift.tt/i6PLTOg

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Insider Sell: Director Dawn Hudson Sells 11,000 Shares of NVIDIA Corp (NVDA) - Yahoo Finance"

Post a Comment