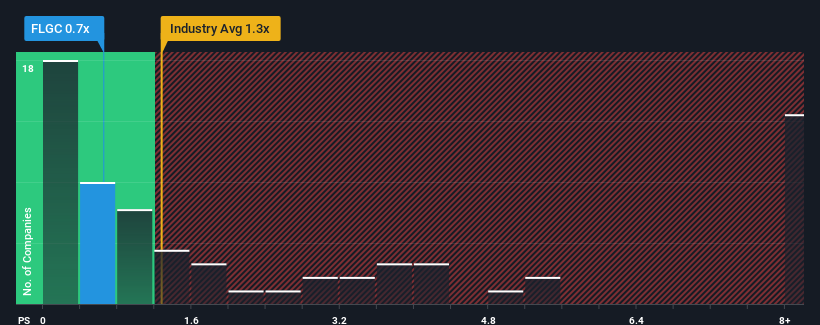

You may think that with a price-to-sales (or "P/S") ratio of 0.7x Flora Growth Corp. (NASDAQ:FLGC) is a stock worth checking out, seeing as almost half of all the Personal Products companies in the United States have P/S ratios greater than 1.3x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Flora Growth

How Flora Growth Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Flora Growth has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Flora Growth will help you uncover what's on the horizon.

Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Flora Growth's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 83% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 7.1% growth forecast for the broader industry.

With this information, we find it odd that Flora Growth is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Flora Growth's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Flora Growth's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 5 warning signs for Flora Growth (2 are a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

"corp" - Google News

June 09, 2023 at 12:13AM

https://ift.tt/wXjc68H

Sentiment Still Eluding Flora Growth Corp. (NASDAQ:FLGC) - Yahoo Finance

"corp" - Google News

https://ift.tt/nHW0fQm

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Sentiment Still Eluding Flora Growth Corp. (NASDAQ:FLGC) - Yahoo Finance"

Post a Comment