Terex Corporation (TEX - Free Report) , a Zacks Rank #1 (Strong Buy), checks off all the boxes in terms of what we look for in a leading stock. Coming out of a bear market, leaders tend to bottom before the major indices. TEX bottomed out in July of last year and has built on the momentum in 2023. Strong demand is leading to rising earnings estimates for this highly-ranked stock. The company’s longevity and continued stock price ascent speak to management’s ability to adapt to the ever-changing market landscape.

TEX sports the second-highest Zacks Value Style Score of ‘B’, indicating an increased probability that the stock propels higher on favorable valuation metrics. The company is part of the Zacks Manufacturing – Construction and Mining industry group, which ranks in the top 2% out of more than 250 Zacks Ranked Industries.

Because this group is ranked in the top half of all industries, we expect it to continue to outperform the market over the next 3 to 6 months. Also note the favorable metrics for this industry group below:

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

Terex manufactures and sells aerial work platforms and materials processing machinery worldwide. Its products include portable material lifts, utility equipment, telehandlers, cranes, concrete mixer trucks and pavement, and conveyors. Used in the construction, infrastructure, mining and recycling industries, its products are sold under recognized brands such as Terex, Fuchs, EvoQuip, Powerscreen and Cedarapids.

Terex’s backlog has shown year-over-year growth for nine consecutive quarters and reached $4.1 billion at the end of the first quarter. This puts TEX in a great position for improved results in the near future. Solid demand and cost savings will help negate the impact of dwindling supply chain disruptions.

Earnings Trends and Future Estimates

TEX has built up an impressive earnings history, surpassing earnings estimates in each of the past four quarters. Back in May, the company reported first-quarter earnings of $1.60/share, a 52.38% surprise over the $1.05 consensus estimate. TEX has delivered a 27.06% average earnings surprise over the last four quarters.

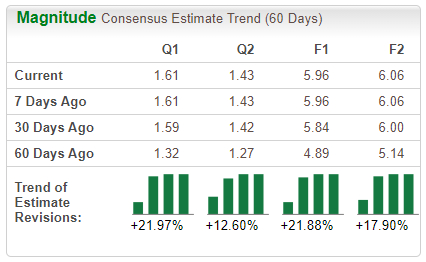

The TEX growth engine is expected to remain hot this year, as analysts covering the company have increased their full-year earnings estimates by 21.88% in the past 60 days. The Zacks Consensus EPS Estimate now stands at $5.96/share, reflecting potential growth of 37.96% relative to last year. Sales are anticipated to climb 11.73% to $4.94 billion.

Image Source: Zacks Investment Research

Let’s Get Technical

TEX shares bottomed out well in advance of the major indices during last year’s bear market. The stock has continued outperforming this year and has doubled in price off the lows. Only stocks that are in extremely powerful uptrends are able to make this type of price move. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how the 200-day moving average (blue line) is now sloping up. The 200-day average has acted as support throughout the move higher. With both strong fundamentals and technicals, TEX is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Terex has recently witnessed positive revisions. As long as this trend remains intact (and TEX continues to deliver earnings beats), the stock will likely continue its bullish run this year.

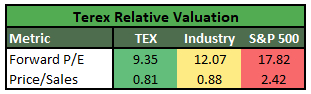

Despite the impressive price run off the lows, TEX remains relatively undervalued:

Image Source: Zacks Investment Research

Bottom Line

Solid institutional buying should continue to provide a tailwind for the stock price. Relative undervaluation and a healthy backlog point to more strength ahead. It’s not too difficult to see why this company is a compelling investment.

Backed by a leading industry group and impressive history of earnings beats, this market winner is primed to build upon its recent run. Robust fundamentals combined with a strong technical trend certainly justify adding shares to the mix. Investors would be wise to consider TEX as a portfolio candidate if they haven’t already done so.

Disclosure: TEX is a current holding in the Zacks Headline Trader portfolio.

"corp" - Google News

June 12, 2023 at 04:02PM

https://ift.tt/mjSMCcw

Bull of the Day: Terex Corp. (TEX) - June 12, 2023 - Zacks Investment Research

"corp" - Google News

https://ift.tt/FpbMHzy

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Bull of the Day: Terex Corp. (TEX) - June 12 2023 - Zacks Investment Research"

Post a Comment