Shareholders in Ero Copper Corp. (TSE:ERO) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

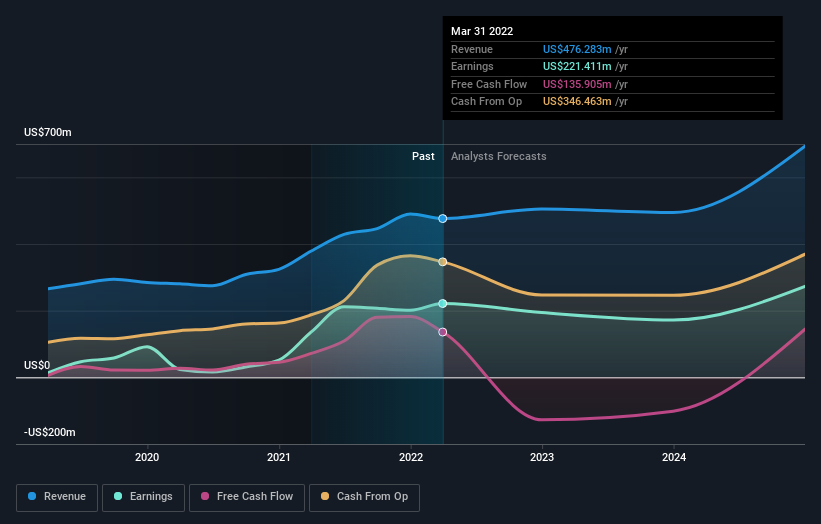

Following the upgrade, the current consensus from Ero Copper's nine analysts is for revenues of US$505m in 2022 which - if met - would reflect an okay 6.1% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$455m in 2022. It looks like there's been a clear increase in optimism around Ero Copper, given the nice increase in revenue forecasts.

See our latest analysis for Ero Copper

There was no particular change to the consensus price target of CA$25.00, with Ero Copper's latest outlook seemingly not enough to result in a change of valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Ero Copper, with the most bullish analyst valuing it at CA$35.00 and the most bearish at CA$21.00 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Ero Copper shareholders.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Ero Copper's revenue growth will slow down substantially, with revenues to the end of 2022 expected to display 8.2% growth on an annualised basis. This is compared to a historical growth rate of 23% over the past three years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 10% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Ero Copper.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Ero Copper.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 3 potential concerns with Ero Copper, including concerns around earnings quality. You can learn more, and discover the 2 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

"corp" - Google News

May 14, 2022 at 07:10PM

https://ift.tt/p6sO7aD

Growth Investors: Industry Analysts Just Upgraded Their Ero Copper Corp. (TSE:ERO) Revenue Forecasts By 11% - Yahoo Finance

"corp" - Google News

https://ift.tt/DefQxWs

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Growth Investors: Industry Analysts Just Upgraded Their Ero Copper Corp. (TSE:ERO) Revenue Forecasts By 11% - Yahoo Finance"

Post a Comment