Silver price outlook

Every day a higher number of market participants fear that the ongoing epidemic of the new coronavirus, which has started spreading globally, may cause serious damage to the economy.

On the tailwind of this, precious metals, which are used by investors as safe-haven assets, are trading higher.

In February, silver gained 1.6% on the London bullion market to trade at $18.05 per Troy ounce as of Thursday.

- Warning! GuruFocus has detected 1 Warning Sign with AG. Click here to check it out.

- AG 30-Year Financial Data

- The intrinsic value of AG

- Peter Lynch Chart of AG

After the short-term effects of the virus pass, longer-term factors for increasing silver prices include trade conflicts amid countries and sluggish and slowing economic growth worldwide.

Mainly based on the above, forecasters predict silver trading over $19 an ounce through 2020.

First Majestic Silver

In order to take advantage of the rising silver price, investors may want to consider investing in First Majestic Silver Corp. (NYSE:AG), as this silver miner is expected to beat most of its competitors.

Wall Street recommends an overweight recommendation rating, which means that its share price is foreseen to outperform the mining industry, and has established an average target price of $10.63, reflecting a 30% upside from Thursday's closing share price of $8.30.

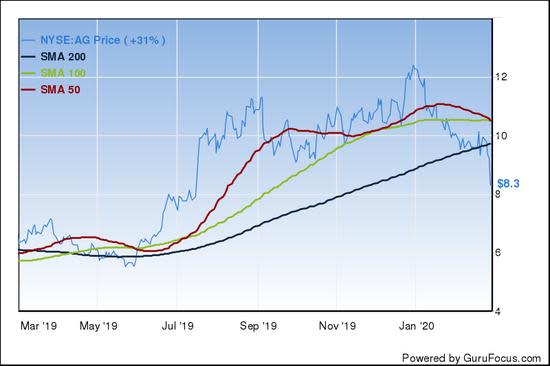

The stock price of the miner is highly connected to silver. The below chart illustrates that First Majestic Silver topped the commodity in the past year as its share price posted a 31% gain while silver futures rose by 11.5%.

The stock currently seems cheap, as its share price is below the 200-, 100- and 50-day simple moving average lines and stands lower than the middle point of the 52-week range of $5.48 to $12.69. The 14-day Relative Strength Indicator of 31 suggests that the stock might be oversold.

However, a price-book ratio of 2.6 versus the industry median of 1.5 and an enterprise value-Ebitda ratio of 43.2 versus the industry median of 8.94 indicate that the stock may not be so cheap after all.

First Majestic Silver mines the grey metal in Mexico, where it possesses approximately 170.915 million ounces of silver equivalent in proven and probable reserves grading 306 grams of silver equivalent in one ton of ore.

In 2019, the company produced about 25.6 million ounces of silver equivalent (up 15% from 22.2 million ounces of metal mined in 2018) at a lower cost as cash costs per ounce declined 26% year over year to $5.16 and all-in sustain costs (aka AISC) per ounce decreased 15% to $12.64.

Lower costs were a result of the intensification of the most efficient activities at richer mineral deposits. Thus, First Majestic Silver holds an excellent portfolio not only from a quantitative and qualitative standpoint of its resources, but also from a flexibility standpoint as it allows activities to focus on higher-yielding assets in order to take the best advantage of rising commodity prices.

A record operating cash flow of $140 million as a result of strong operating results last year, plus other funds from investing and financing activities, strengthened the balance sheet, which is now more prepared to sustain mining, exploration and development activities in 2020.

The company says that it will mine about 21.5-24 million ounces of silver equivalent this year. In addition to proven and probable reserves, First Majestic Silver has almost 90 million ounces of silver equivalent stored in measured and indicated mineral resources grading 392 grams of metal per ton of mineral.

Disclosure: I have no positions in any security mentioned.

Read more here:

- 3 Stocks Growing Sales Fast

- Why You Should Have Endeavour Silver in Your Portfolio

- A Potentially Overlooked Trio to Consider

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

- Warning! GuruFocus has detected 1 Warning Sign with AG. Click here to check it out.

- AG 30-Year Financial Data

- The intrinsic value of AG

- Peter Lynch Chart of AG

"corp" - Google News

February 28, 2020 at 11:52PM

https://ift.tt/2I6RHPj

Why First Majestic Silver Corp Is a Moderate Buy - Yahoo Finance

"corp" - Google News

https://ift.tt/2RhVoHj

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Why First Majestic Silver Corp Is a Moderate Buy - Yahoo Finance"

Post a Comment