As you might know, Plexus Corp. (NASDAQ:PLXS) just kicked off its latest quarterly results with some very strong numbers. Plexus beat earnings, with revenues hitting US$852m, ahead of expectations, and statutory earnings per share outperforming analyst reckonings by a solid 10%. This is an important time for investors, as they can track a company’s performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. We’ve gathered the most recent statutory forecasts to see whether analysts have changed their earnings models, following these results.

View our latest analysis for Plexus

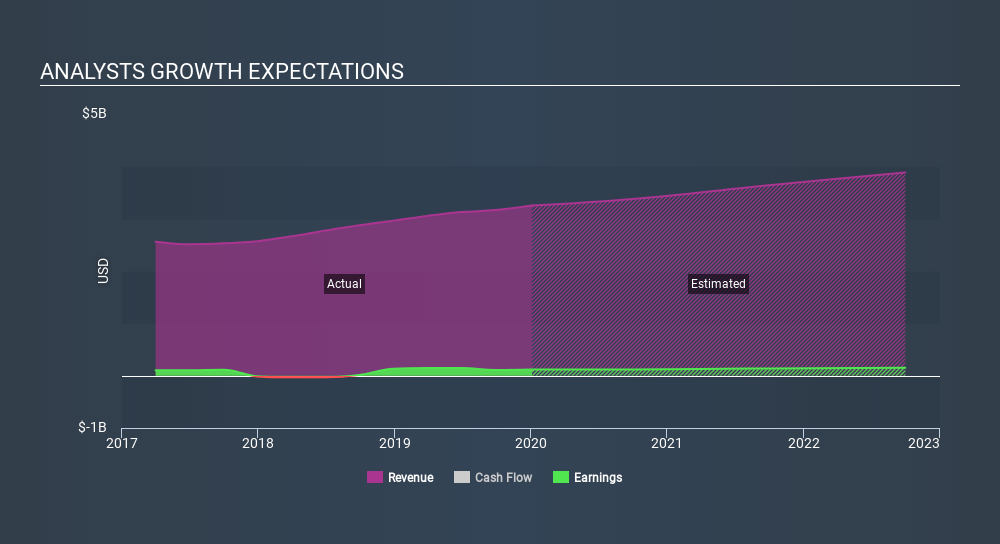

After the latest results, the five analysts covering Plexus are now predicting revenues of US$3.37b in 2020. If met, this would reflect a credible 3.8% improvement in sales compared to the last 12 months. Statutory per share are forecast to be US$3.98, approximately in line with the last 12 months. In the lead-up to this report, analysts had been modelling revenues of US$3.34b and earnings per share (EPS) of US$4.09 in 2020. Analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share forecasts for next year.

Although analysts have revised their earnings forecasts for next year, they’ve also lifted the consensus price target 10% to US$84.17, suggesting the revised estimates are not indicative of a weaker long-term future for the business. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company’s valuation. Currently, the most bullish analyst values Plexus at US$93.00 per share, while the most bearish prices it at US$75.00. The narrow spread of estimates could suggest that the business’ future is relatively easy to value, or that analysts have a clear view on its prospects.

Another way to assess these estimates is by comparing them to past performance, and seeing whether analysts are more or less bullish relative to other companies in the market. We can infer from the latest estimates that analysts are expecting a continuation of Plexus’s historical trends, as next year’s forecast 3.8% revenue growth is roughly in line with 4.5% annual revenue growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 5.1% per year. So it’s pretty clear that Plexus is expected to grow slower than similar companies in the same market.

The Bottom Line

The most important thing to take away is that analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations – although our data does suggest that Plexus’s revenues are expected to perform worse than the wider market. Analysts also upgraded their price target, suggesting that analysts believe the intrinsic value of the business is likely to improve over time.

With that in mind, we wouldn’t be too quick to come to a conclusion on Plexus. Long-term earnings power is much more important than next year’s profits. We have forecasts for Plexus going out to 2022, and you can see them free on our platform here.

You can also see whether Plexus is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more."corp" - Google News

January 27, 2020 at 06:13PM

https://ift.tt/36uDeXd

Plexus Corp. Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions - Simply Wall St

"corp" - Google News

https://ift.tt/2RhVoHj

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Plexus Corp. Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions - Simply Wall St"

Post a Comment