Given the ongoing turmoil in the banking industry and expectations of recession in the near-term, solid dividend-yielding stocks are highly desirable. One such stock is Associated Banc-Corp ASB.

This Green Bay, WI-based bank offers an array of banking and non-banking products and services. ASB provides a full range of financial products and services through more than 200 banking offices in Wisconsin, Illinois and Minnesota as well as commercial financial services in Indiana, Michigan, Missouri, Ohio and Texas.

Associated Banc-Corp has been increasing its quarterly dividend on a regular basis, with the last hike of 5% to 21 cents per share announced in October 2022. Over the past five years, the company increased the dividend four time, with annualized dividend growth rate of 6.41%.

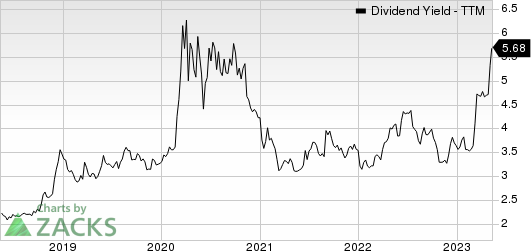

Considering last day’s closing price of $14.79, the company’s dividend yield currently stands at 5.68%. This is impressive compared with the industry average of 3.75% and attractive for income investors as it represents a steady income stream.

Associated Banc-Corp Dividend Yield (TTM)

Associated Banc-Corp dividend-yield-ttm | Associated Banc-Corp Quote

Is the Associated Banc-Corp stock worth a look to earn a high dividend yield? Let’s check out the company fundamentals to understand risk and rewards. This will help us make a proper investment decision.

Associated Banc-Corp is taking measures to improve operating efficiency. In September 2021, the company announced a new strategic expansion program, which has already resulted in the growth of its lending capabilities and will keep supporting core business growth and transforming digital capabilities. The plan includes the addition of “higher-margin” lending portfolios and digital investments, which are expected to bolster revenues, operating leverage and profitability over time.

Driven by these, management surpassed the targets set for commercial loan balances and asset-based lending and equipment finance loan balances in 2022, while it slowed down auto finance expansion to align with the current market conditions. For 2023, management expects total loans to grow in the range of 6-8%. Our estimates for gross loans suggest a CAGR of 4.8% by 2025.

Associated Banc-Corp remains focused on its organic growth strategy. While the company’s total revenues declined in 2021, it witnessed a CAGR of 2.9% over the six-year period ended 2022. The company expects the expansion of its lending capabilities to help drive incremental revenues, going forward. We expect total revenues (FTE) to grow 8% this year.

Amid the industry-wide deposit outflows, ASB recorded 2.4% sequential growth in deposits during the first quarter of 2023 and another 3.3% jump from the end of the quarter till Apr 19. As of Mar 31, 2023, its uninsured, uncollateralized deposits were only 24% of total deposits. The company expects average core customer deposit growth of 1-3% this year.

It must be noted that during the time when ASB was able to garner more deposits, several regional banks, including Signature Bank and Silicon Valley Bank, witnessed deposit flights, leading to their collapse in early March. Both the banks - Signature Bank and Silicon Valley Bank - were seized by the FDIC and then sold to New York Community Bancorp, Inc. NYCB and First Citizens BancShares, Inc. FCNCA, respectively.

NYCB, through its bank subsidiary, Flagstar Bank, acquired $38 billion in assets and assumed $36 billion of liabilities of Signature Bank, while not buying any digital asset banking, crypto-related assets or the fund banking business. FCNCA assumed Silicon Valley Bank’s assets worth $110 billion, deposits worth $56 billion and loans worth $72 billion.

Therefore, amid the regional banking crisis, ASB was able to stop deposit outflows and even witnessed solid growth. Despite near-term headwinds like rising expenses and a worsening operating backdrop, ASB stock is fundamentally solid.

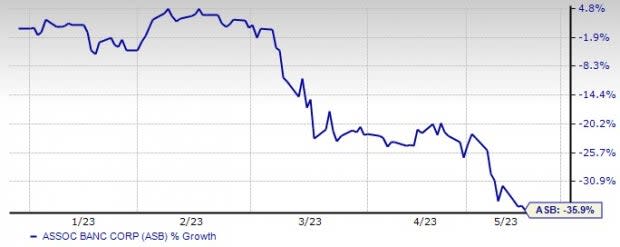

Also, the stock has lost 35.9% so far this year and is currently trading just 1.7% above its 52-week low, making a compelling “buy on the dip” choice.

Yaer-to-Date Price Performance

Image Source: Zacks Investment Research

Therefore, income investors must keep this Zacks Rank #3 (Hold) stock on their radar as this will help generate robust returns over time. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

"corp" - Google News

May 12, 2023 at 07:56PM

https://ift.tt/HSg6PcG

Should You Watch Associated Banc-Corp (ASB) for Solid Dividend? - Yahoo Finance

"corp" - Google News

https://ift.tt/z9JPABr

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Should You Watch Associated Banc-Corp (ASB) for Solid Dividend? - Yahoo Finance"

Post a Comment