Oscar Gutierrez Zozulia/iStock via Getty Images

Co-authored with Treading Softly.

When I was a child, I used to love sitting in my bedroom listening to the storm, the rumbling of the thunder outside, and the sound of rain hitting my window. The louder and stronger, the better. I never realized how much stress the same situation caused my father when I was a child.

It wasn't until I was a father and owned a home that I realized that the stress brought on by storms was less about the storm itself and more about the potential damage to the largest investment I had ever made in my life. Living in Florida, the threat of a hurricane destroying your home is always a risk during hurricane season.

Real estate is one of the oldest and best methods people have used to see their wealth grow over time. Even those who are intimidated about investing seem to understand that buying a home with a 30-year or 15-year mortgage is a great way to secure property and build equity over time. Often they don't realize that this is making a leveraged bet that they will be able to make those payments on time, grow the value of their home, and that property values will rise.

When investing in the stock market, I always try to approach it from the viewpoint of an income investor, someone using the market as a tool to generate income for their long-term wealth. Part of doing this is merging what I see in everyday life with what's available in the market, to understand better where income could be found. One of those areas is in real estate.

Today, I want to look at an opportunity to invest in real estate to pay you regular monthly income into your portfolio. What if, instead of paying a mortgage, you were paid by other people paying their mortgages?

Take your understanding of why people like to have mortgages and mix that with the need for income to cover your expenses; you will create a beautiful creation called a real estate investment trust, or REIT.

The most common type of mortgage in the U.S. is a "conventional" mortgage that is sold to Fannie Mae or Freddie Mac. These "agencies" then put a guarantee on your mortgage and resell it to investors. If you default on your mortgage, the agency will still pay the investor. This system encourages investors to provide capital for mortgages at much lower interest rates than they would otherwise be willing to provide. Today, we are going to look at a mortgage REIT that invests in these mortgages.

AGNC

AGNC Investment Corp. (NASDAQ:AGNC) is a mortgage REIT that buys these agency MBS, collecting the coupon and paying investors a dividend. Since the mortgages have no credit risk, AGNC utilizes leverage to increase returns. The returns that AGNC receives are a function of the price they pay to borrow, the yield they receive from the mortgages, and interest rate movements.

AGNC reported Q1 earnings that were very similar to what we have seen over the past year. Income remains very high, and book value struggled.

Net spread and dollar roll income came in at $0.70, covering its $0.36 dividend by about 195%. This is much higher coverage than AGNC has had historically, which has typically been 100-120%.

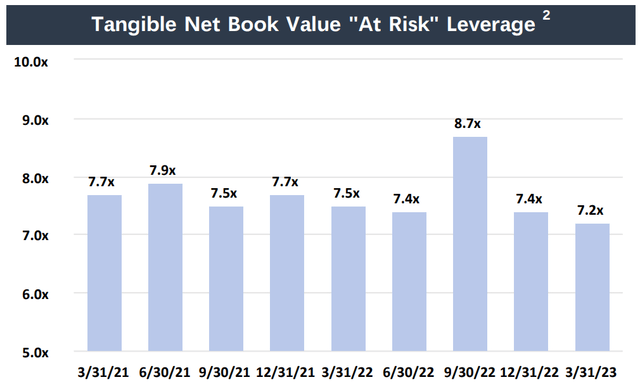

AGNC achieved this level of earnings while operating at the lowest leverage levels it has had in over two years. Source.

AGNC Q1 2023 Presentation

In Q4 2019, AGNC had a leverage rate of 9.4x and earned $0.57. AGNC's earnings are higher because MBS spreads are higher. Higher spreads = higher cash flow. The trade that AGNC engages in seeks to profit from the difference between U.S. Treasuries and Agency MBS. The larger that difference is, the higher the cash flow to AGNC. The whole premise of the strategy is that Agency MBS will have a higher yield but a similar credit risk compared to U.S. Treasuries.

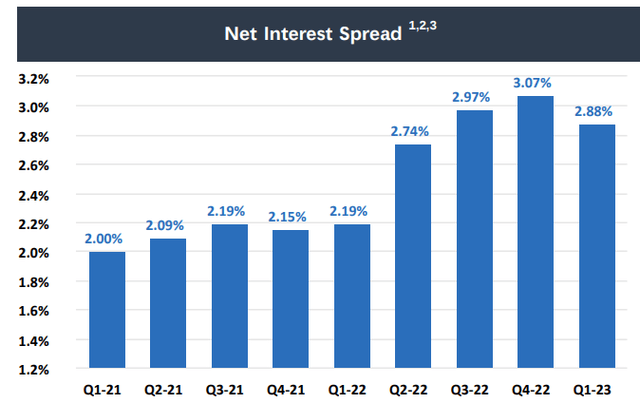

The "Net Interest Spread" measures AGNC's actual effective yield received minus the actual cost of funds. It sits at 2.88%.

AGNC Q1 2023 Presentation

While it ticked down slightly from Q4, this is extraordinarily high compared to history. From 2018-2019, this metric ranged from 1.00%-1.35%. It typically varies quarter to quarter as it is sensitive to changes in interest rates and changes in AGNC's hedging.

If earnings are so high, why is book value so low? The same reason. AGNC is long agency MBS, and short U.S. Treasuries. While these two assets tend to have a very strong correlation, they are not identical. Sometimes, the pricing between the two varies.

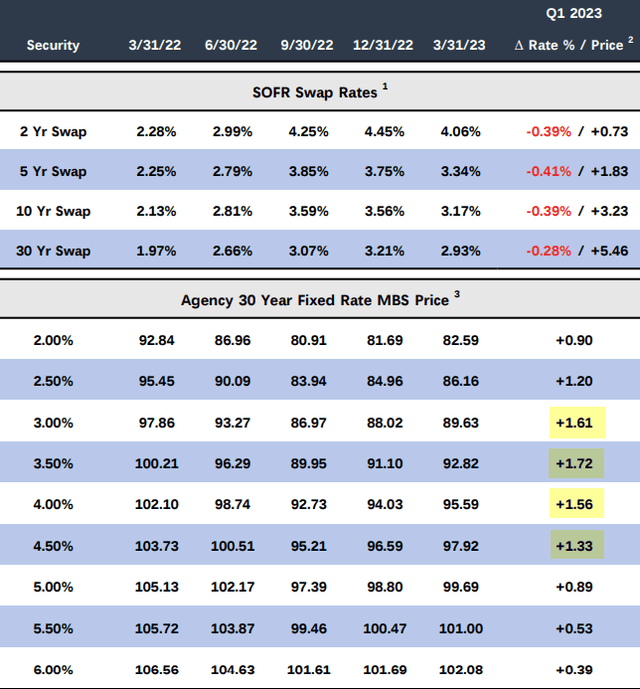

Agency MBS went up last quarter. Most of AGNC's assets fall in the 3-4.5% range, which went up $1.33-$1.72.

AGNC Q1 2023 Presentation

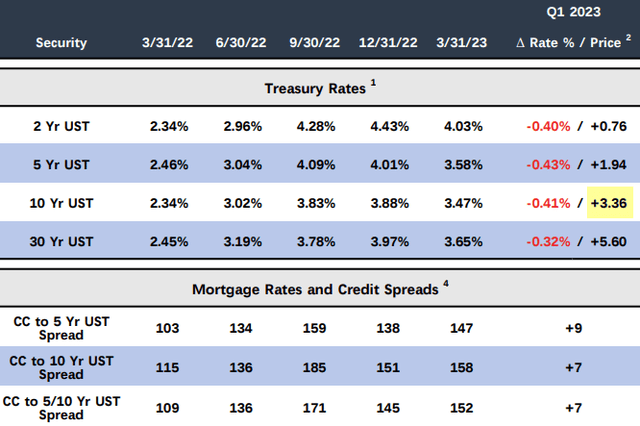

So if the prices of agency MBS went up, why did AGNC's book value go down? They are short U.S. Treasuries. Going into Q1, they were primarily short the 10-year.

AGNC Q1 2023 Presentation

While the MBS AGNC hold went up $1.33-$1.72, their short position went down $3.36. The decline in the short position exceeded the gains from the long position. The CC (current coupon) to 5/10 Yr UST (U.S. Treasury) Spread is a shorthand way of measuring this relationship. You can see how the spread has gone from 109 bps to 152 bps at the end of Q1. The higher this spread is, the lower book value will be. This spread has averaged around 75 bps over the past decade. The spread widened by 7 bps last quarter.

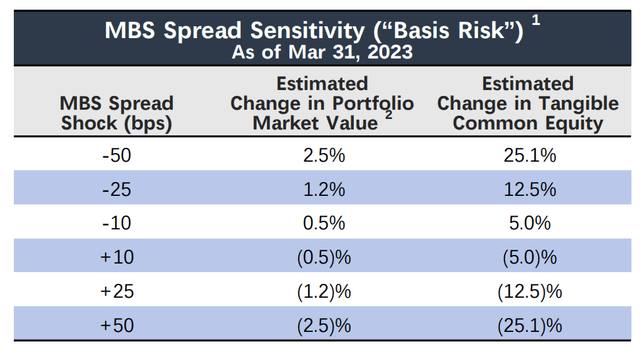

Every quarter, AGNC provides a table measuring its sensitivity to this spread as of the last day of the quarter, assuming an overnight move without any changes in the portfolio to mitigate it.

AGNC Q1 2023 Presentation

You can see that a 10 bps swing in either direction impacts book value by about 5%. Last quarter, this table predicted a 6.1% change for every 10 bps swing. So with a 7 bps widening, AGNC would have predicted a change in book value of approximately -4.27%. The actual book value change for the quarter was -4.36%. Entering Q2, AGNC was a bit more conservatively positioned.

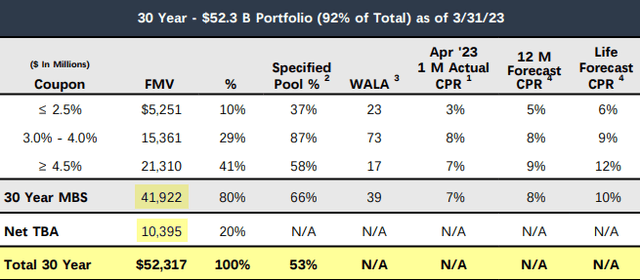

AGNC made three material changes to their portfolio during the quarter. First, they bought MBS, primarily with coupons of 4.5% and higher, and they reduced their TBA exposure.

AGNC Q1 2023 Presentation

In Q4, they had $36.2 billion in 30-year MBS and $18.5 billion in TBA. Overall, this led to a smaller portfolio since the decline in TBA was smaller than the increase in MBS. Some have been claiming that this is AGNC "selling" its portfolio. This isn't true. TBA are futures contracts. As futures, they come with an expiration date, usually within a few months. The "dollar roll" strategy was very profitable for AGNC last year, allowing them to use futures to reduce their financing costs artificially. That has changed, so AGNC has been rotating out of TBA and into MBS as these contracts expire and their cash is freed up.

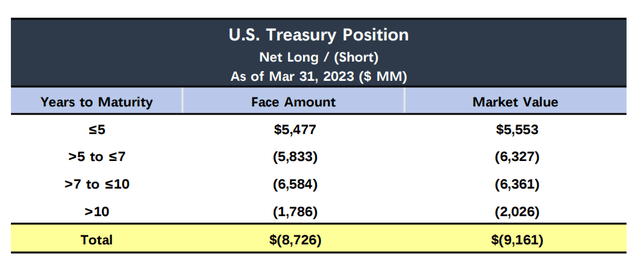

The third major change was AGNC took a long position in 5-year U.S. Treasuries. It is now long $5.5 billion in the 5-year while maintaining a $9.1 billion net short position on the longer end of the curve.

AGNC Q1 2023 Presentation

This change makes AGNC slightly less sensitive to widening spreads between Treasuries and MBS while also positioning it to benefit if the yield curve starts steepening. If the yield curve steepens, this positioning could cause AGNC's book value to outperform.

It has been a difficult environment for bond investors, and Agency MBS are highly correlated to bonds. AGNC has navigated this environment while maintaining a very high level of cash flow. Last quarter, we saw AGNC become a net buyer of agency MBS, while its leverage remains very low.

On the earnings call, management stated their belief that they expect MBS spreads to remain around 150 bps for an extended period, thanks to some banks being forced sellers and the Fed no longer being a major buyer. They are buyers of MBS, but are not in a hurry. This is a more conservative approach than some peers are taking, but it is also one of the reasons why AGNC's dividend has been more stable. It is inevitable that MBS prices will strengthen relative to Treasuries. The great unknown is "when". Unlike banks that have to sell at bad prices to meet deposits, AGNC has the luxury of holding to maturity if it wants. Q1's book value represents AGNC's MBS trading at a $3.02/share discount to par value. That is a value that will be regained when mortgages prepay or when they mature.

Conclusion

AGNC Investment Corp. can pay you large sums of regularly recurring income directly into your account through dividends. I'm not talking about the pennies you receive from your bank savings account or the pitiful little dollars that stumbled in from your local money market. I'm talking about large amounts of recurring income you can rely on month in and month out, regardless of what the economy decides to do tomorrow, because people will continue to take out mortgages. When they pay their mortgage, you get a cut of that payment. If they don't pay, the agencies step in and make up the loss.

This shouldn't come as a surprise to you – when you enter retirement, life isn't free. You will continue to have bills. You'll continue to need to pay for food at the grocery store, and you'll continue to need to take care of unexpected expenses that arise. The biggest difference about retirement is that you're no longer working, and the income you're generating must come from your investments, Social Security, or any pension you may have earned during your working years.

I want you to have a retirement that is paid for in dividends from the market. That way, you don't have to worry about those other expenses because they are not just covered – they are overwhelmed by a tsunami of dividends coming from the market directly into your account. That's how we achieve this with a "model portfolio" with +45 great dividend picks and an overall yield of +9%.

That's the beauty of our Income Method, and that's the result of income investing.

"corp" - Google News

May 04, 2023 at 06:35PM

https://ift.tt/0MBiAYm

Paying A Mortgage? Time To Get Paid: AGNC Investment Corp. (NASDAQ:AGNC) - Seeking Alpha

"corp" - Google News

https://ift.tt/31Xx7Wd

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Paying A Mortgage? Time To Get Paid: AGNC Investment Corp. (NASDAQ:AGNC) - Seeking Alpha"

Post a Comment