Key Insights

-

Given the large stake in the stock by institutions, Park Aerospace's stock price might be vulnerable to their trading decisions

-

The top 10 shareholders own 50% of the company

-

Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

To get a sense of who is truly in control of Park Aerospace Corp. (NYSE:PKE), it is important to understand the ownership structure of the business. We can see that institutions own the lion's share in the company with 79% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Because institutional owners have a huge pool of resources and liquidity, their investing decisions tend to carry a great deal of weight, especially with individual investors. As a result, a sizeable amount of institutional money invested in a firm is generally viewed as a positive attribute.

In the chart below, we zoom in on the different ownership groups of Park Aerospace.

Check out our latest analysis for Park Aerospace

What Does The Institutional Ownership Tell Us About Park Aerospace?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

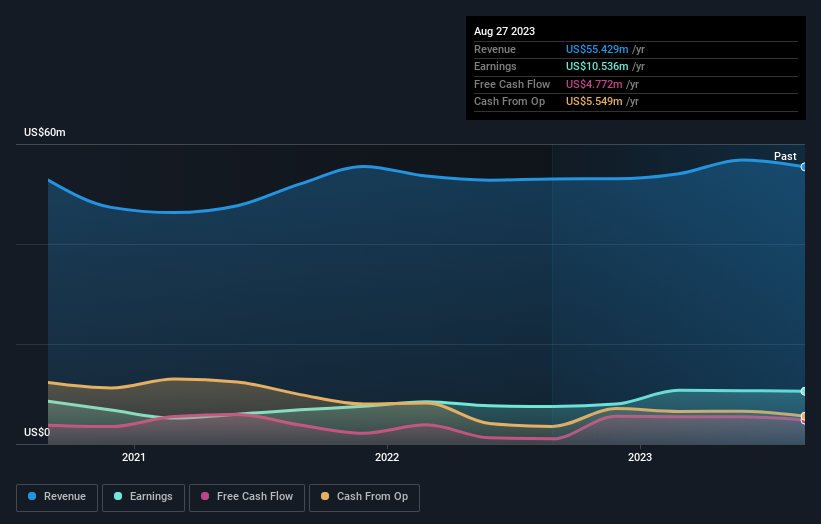

We can see that Park Aerospace does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Park Aerospace's earnings history below. Of course, the future is what really matters.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. It looks like hedge funds own 5.0% of Park Aerospace shares. That's interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. Our data shows that Brandes Investment Partners, LP is the largest shareholder with 7.0% of shares outstanding. For context, the second largest shareholder holds about 6.6% of the shares outstanding, followed by an ownership of 5.9% by the third-largest shareholder. Additionally, the company's CEO Brian Shore directly holds 5.0% of the total shares outstanding.

We did some more digging and found that 10 of the top shareholders account for roughly 50% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Park Aerospace

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

We can see that insiders own shares in Park Aerospace Corp.. In their own names, insiders own US$18m worth of stock in the US$289m company. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

General Public Ownership

With a 10% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Park Aerospace. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Park Aerospace (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

"corp" - Google News

October 22, 2023 at 09:15PM

https://ift.tt/TBVlPui

Park Aerospace Corp. (NYSE:PKE) is favoured by institutional owners who hold 79% of the company - Yahoo Finance

"corp" - Google News

https://ift.tt/17TBLNc

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Park Aerospace Corp. (NYSE:PKE) is favoured by institutional owners who hold 79% of the company - Yahoo Finance"

Post a Comment