Thank you for your assistant/iStock via Getty Images

I am recommending Unit Corporation (OTCQX:UNTC) as a buy primarily due to its impressive 227% increase in operations income, 150% increase in cash from operations, and the elimination of all of its debt between December of 2022 and March of 2023. While the stock might only be up 2.37% year to date this impressive performance going into a market where, according to the international energy agency, oil demand will increase by 2.2 million barrels of oil a day to reach a new record demand of over a 102 million barrels a day. This increase in demand coupled with the renewal of UNTC's lucrative oil rig contracts and their desire to sell off unproductive assets and return that money to shareholders in the form of dividend payments gives me the conviction that UNTC shareholders have some large profits headed their way.

The vast majority of my figures come directly from UNTC's 2022 10-K and UNTC's 2023 Q2 10-Q. If the reader wishes to look into these documents further, I have provided links for you to reference.

Unit Corporation

Founded in 1963, Unit Corp. began as an oil and natural gas contract drilling company and has since grown into a corporation that is now involved with oil and natural gas exploration and production as well as holding a 50% stake in a midstream pipeline company. UNTC's operations are broken down into three basic business segments which consist of:

- Oil and Natural Gas - Ran under the UNTC subsidiary Unit Petroleum Company this segment produces, develops, and acquires oil and natural gas properties for UNTC.

- Contract Drilling - Ran under the subsidiary Unit Drilling Company, this segment drills onshore oil and natural gas wells for both Unit Petroleum and for third party contracts.

- Mid-Stream - Until April of 2023 UNTC held a 50% investment in Superior Pipeline Company L.L.C. which buys, sells, gathers, processes, and treats natural gas and natural gas liquids for third parties and for UNTC's subsidiary Unit Petroleum Company. UNTC acted as the operating company for Superior Pipeline Company L.L.C. under the subsidiary SPC Midstream Operating, L.L.C.

These 3 segments, as of December 31st, 2022, employed 653 people. 512 of them working in the contract and drilling business, 102 in the oil and natural gas business, and 39 people employed under UNTC's general corporate group.

2022 Income from UNTC's Core Businesses

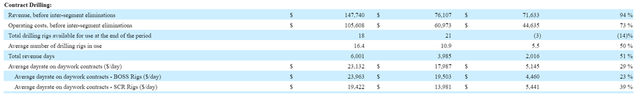

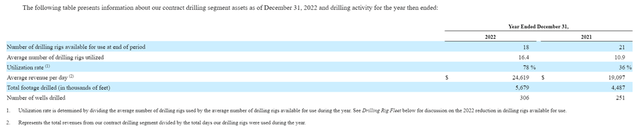

UNTC's subsidiary Unit Drilling Company had an exciting amount of growth between 2021 and 2022 with a 94% increase in revenue from $76.1 million to $147.7 million. A convergence of an increase in day rate contracts year over year (39% on their BOSS rigs and 23% on their SCR rigs) and a 50% increase in average number of drilling rigs in use being the primary cause.

UNTC Contract Drilling Revenue (UNTC 2022 10-K)

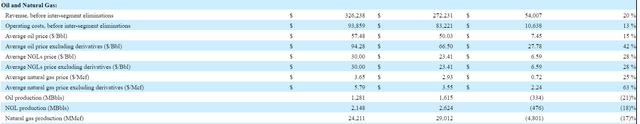

The oil and natural gas segment ran under the subsidiary Unit Petroleum saw a 20% increase in year over year revenue from $272.2 million to $326.2 million. These Unit Petroleum revenue increases came from higher commodity prices. Oil prices increased 15% to $57.48 per barrel in 2022 and the average Henry Hub real natural gas price rose 53% and ranged from $9.85 MMBtu to $3.46 MMBtu from June of 2021 to June of 2022.

UNTC Oil and Natural Gas Revenue (UNTC 2022 10-K)

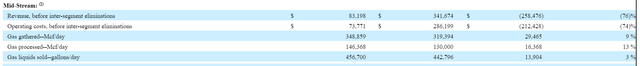

On March 1st 2022 Superior Pipeline L.L.C. was deconsolidated from UNTC's revenue figures and therefore the revenue figures captured on UNTC's 2022 10-K only reflect the first two months of the year leading to a 76% decrease in revenue from $341.7 million to $83.2 million and a 74% decrease in operating costs year over year from $286 million to $73.8 million.

Superior Pipeline Revenue (UNTC 2022 10-K)

Overall these substantial gains led to a 125% year over year operating income increase from $76.3 million to $172 million and a 196% increase in earnings from continuing operations from $48.2 million to $142.5 million from 2021 to 2022.

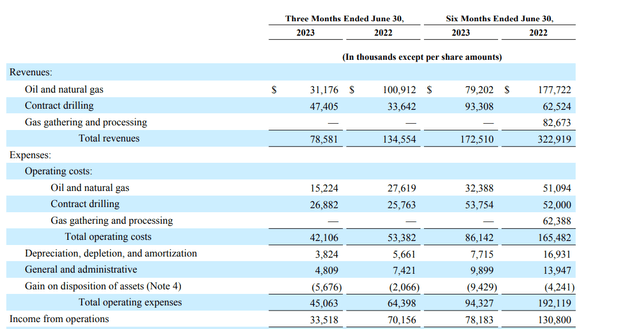

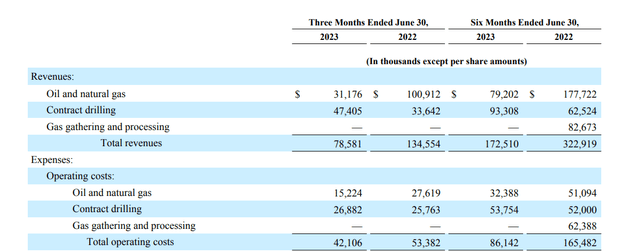

2023 Core Business Income

UNTC's drilling revenues continued to see an exciting amount of growth in 2023. A 49% ($30.8 million) increase in revenue brings Unit Drilling Company to $93.3 million in revenue for the first 6 months of 2023 from $62.5 million in revenue earned during the first six months of 2022. Average day rate increases of 50% on Unit Drilling's BOSS rigs and a 34% average day rate increase on their SCR rigs are the primary drivers of UNTC's drilling business revenue growth while its contract drilling operating costs only increased a mere 3% during the same time period.

Revenues from Oil and Natural Gas and Contract Drilling (UNTC 2023 Q2 10-Q)

UNTC subsidiary Unit Petroleum Company saw a large 58% decrease in revenues during the first six months of 2023 due to a trifecta of sinking natural gas, natural gas liquids, and oil prices from all-time highs in the first half of 2022, mixed with UNTC's large sell off of drilling properties in 2021 and 2022 which by default also led to lower production numbers. UNTC has expressed a lot of interest in selling off large parts of its volatile gas and oil business and in 2021 sold off $23.4 million worth of gas and oil wells before doubling that number to $49 million worth in 2022. 2022's well sell off accounted for 21% of Unit Petroleum's total oil and natural gas properties. That 21% of its properties Unit Petroleum sold off corresponds rather perfectly to the 21% reduction in natural gas production, 23% decrease in oil production, and 31% decrease in natural gas liquids production Unit Petroleum also experienced. The remaining productive properties suffered from declining commodity prices. The average price for a barrel of oil fell 27%, the price of natural gas liquids fell 47%, and natural gas prices tumbled 60% all while the cost of operations only decreased by 37% to $32.4 million from $51.6 million in the first six months of 2022.

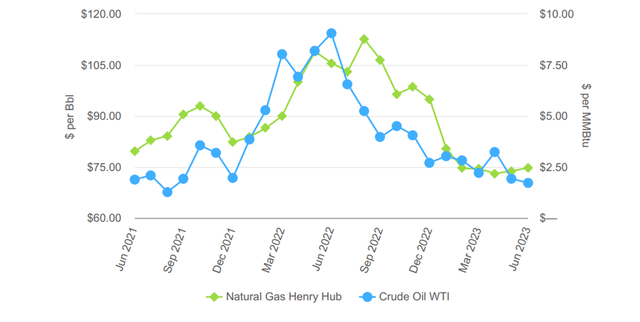

Crude Oil and Natural Gas Prices June 2021 - June 2023 (UNTC 2023 Q2 10-Q)

All of these changes and sell offs to UNTC's businesses led to $78.2 million in income from operations during the first six months of 2023 compared to $130.8 million in income from operations in the first six months of 2022. The major reason UNTC's income from operations contracted so sharply in the first six months of 2023 is because Superior Pipeline was still being listed under operations income until March of 2022 which provided UNTC with an additional $82.7 million in revenue during Q1 of 2022 as well as the company selling off interest in 727 wells in 2022 from its oil and natural gas business.

Other Income from 2021 and 2022

As mentioned above UNTC has been committed to selling off non-core or non-productive assets within its various businesses and sold off $12.7 million worth of non-core contract drilling assets in 2021 and $12.8 million drilling assets in 2022 leading to a net gain of $10.1 million in 2021 and $8.4 million in 2022. In 2021 UNTC saw its oil and natural gas business Unit Petroleum sell off various gas and oil wells and related leases in several states with cash proceeds net of customary closing and post-closing adjustments amounting to $23.4 million. In 2022 UNTC doubled the amount of gas and oil wells and related leases sold to $49 million worth. Other non-core oil and natural gas assets sold off for $5 million in 2021 and $7.7 million in 2022. UNTC also saw interest income of $2.6 million in 2022 compared to $0 in 2021 because of its larger cash holdings from its larger income and asset sales. Net income increased 145% from $60.6 million to $148.4 million from 2021 to 2022.

Other Income from 2023

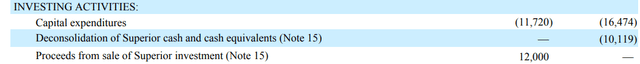

In April of 2023, UNTC sold its 50% stake in Superior Pipeline for $20 million. Unit received $12 million at the closing of the sale and is entitled to the other $8 million 12 months after the date of sale. In May of 2023 UNTC closed on the sale of two of its SCR drilling rigs for $5.8 million as the company reduces its fleet to taper down to what it projects will be the future demand for oil and gas. UNTC also sold off $9.5 million in other non-core assets in its drilling business in the first six months of 2023 and another $1 million in non-core assets from its oil and natural gas business.

Superior Pipeline Sales Figure (UNTC 2023 Q2 10-Q)

The company did spend a lot of time narrowing down its business focus over the last three years. By selling off $73.4 million worth of its wells from its oil and gas business, $40.8 million worth of its drilling business assets in the past two and a half years, and selling all of its stake in Superior Pipeline in 2023 UNTC is setting itself up for a more streamlined business model focused primarily on the less volatile contract drilling segment of its operations.

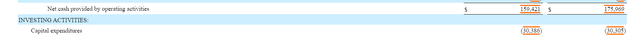

2021 And 2022 Cash Flow

UNTC's net cash from operating activities in 2022 was $159.4 million compared to $176 million in net cash in 2021. This $16.6 million decrease (9.4%) can be attributed to the absence of operating cash flows from Superior Pipeline after March 1st 2022 and from higher payments on derivative settlements. 2021 was the first year showing a positive net income for UNTC since 2017 with a $60.6 million of net income in 2021 jumping all the way to $148.4 million in 2022 while at the same time UNTC's debt shrank from $65.3 million in 2021 to just $4.8 million in 2022. A reduction in all of its debt should give UNTC a lot of freedom in future financial decisions as they won't be as sensitive to how future interest rate hikes will affect their interest and principle payments on their current debt load.

UNTC Capital Expenditure and Net Cash from Operations (UNTC 2023 Q2 10-Q)

2023 Cash Flow

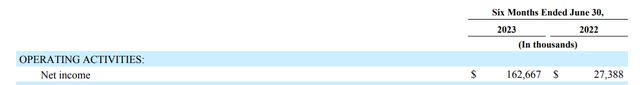

The first six months of 2023 saw Unit Corp. earn $162.7 million in net income vs. $27.4 million in the first six months of 2022 and UNTC ended its second quarter with $199.8 million in unrestricted cash and cash equivalents with a positive working capital balance of $207.1 million. Cash and cash equivalents jumped 72.8% from 2022's $115.6 million and will be used to pay out two $2.50 dividends later this year, one during the third quarter and one during fourth quarter of 2023.

UNTC Net Income (2023 Q2 10-Q)

Cash and Cash Equivalents (UNTC 2023 Q2 10-Q)

The $2.50 dividend paid out on June 26th, 2023 cost UNTC $24.1 million so two more $2.50 payments will likely use up somewhere between $48 - $50 million from UNTC's pile of cash. Even after another hefty 2 dividend payments UNTC should still be sitting on close to $150 million in cash and cash equivalents and management should use this liquidity to offer up more dividend payments and stock buybacks. Even after Q3 and Q4's dividend payments UNTC will still be holding onto a record amount of cash that is unprecedented when looking at the company's history. It is also holding onto this much cash while getting rid of large sections of its business and it is on this basis that my argument for an increase in either buybacks or dividends rests, primarily because a sell off of their business assets should correlate to less capital expenditure used in their remaining businesses.

Balance Sheet

Drilling Segment

In 2022, the average number of drilling rigs Unit Drilling utilized went from 10.9 to 16.4 raising its oil rig utilization rate from 36% in 2021 to 78% in 2022. On top of more drilling rigs coming into operation UNTC's average revenue per day increased from $19,097 to $24,619.

Oil Rig Utilization Rate (UNTC 2022 10-K)

Oil and Natural Gas

UNTC's subsidiary Unit Petroleum Company had a $47 million decrease in proved oil and natural gas properties from 2021 to 2022 from $225 million to $177 million. This decrease on property value comes from UNTC's announcement that it had expanded its 2021 divestiture program to include potentially the sale of all of its oil and natural gas properties and reserves. While UNTC did end the relationship with the financial advisor it had hired to advise them through these sales in June of 2022 they did see the sell off of all of their Texas Gulf Coast oil and gas properties and related leases for $45.4 million as well as the sale of wells and related leases near the Oklahoma pan handle worth $3.6 million. Thus far in 2023 Unit Petroleum has only made $1 million in proceeds from the sale of its non-core oil and natural gas assets.

Superior Pipeline

Unit Corp owned a 50% stake in Superior Pipeline L.L.C. and acted as an operator to the company under its subsidiary company SPC Midstream Operating, L.L.C. where UNTC received $300,000 a month to provide Superior Pipeline with operations and maintenance support, accounting, legal, and human resource services. Superior's value as of March 1st, 2022 is listed under the equity section of UNTC's balance sheet which would explain their $175.2 million increase in common equity from $187.4 million to $362.6 million from 2021 to 2022. In April of 2023, UNTC sold its 50% stake in Superior Pipeline for $20 million.

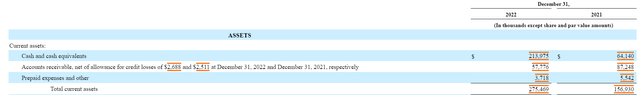

Cash

Aided largely by their drilling business segment's massive increase in revenue from having more rigs active in the field and from the sales of their oil and natural gas properties and related leases UNTC saw a 234% increase in cash and cash equivalents on their balance sheet from $64.1 million in 2021 to $214 million 2022.

UNTC Current Assets (UNTC 2022 10-K)

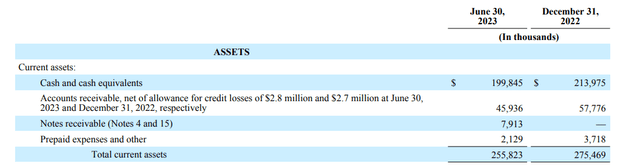

As of June 30th, 2023 UNTC has had a 6.6% decrease in cash and cash equivalents to $199.8 million, however UNTC also has $7.9 million in notes receivable at the end of June 2023 compared to no notes receivable at the end of 2022. Bringing this into account UNTC should soon have $207.7 million in cash on hand bringing the total realistic cash decrease down just 2.9% from the end of 2022. This change in cash isn't significantly surprising when taking into account how much in dividends UNTC has paid out so far in 2023 and in fact, UNTC still has a significant amount of liquidity for future dividend payments and or stock buybacks.

UNTC Current Assets (UNTC 2023 Q2 10-Q)

Liabilities

Currently, UNTC has no debt and in the first six months of 2023 paid only $335,000 in income taxes. Operating costs for all business segments either decreased or remained practically unchanged when comparing the first six months of 2022 to the first six months of 2023. Superior Pipeline's operating costs are completely non-existent as UNTC has completely parted ways with the company selling off its 50% stake this past April. Unit Petroleum's oil and natural gas business, due to its large well sell offs in 2022, has reduced its operating costs by 37% from $51.6 million in 2022 to $32.4 million in 2023. The only segment to increase its operating costs in the first six months of 2023 is Unit Drilling which saw a slight 3% rise of $1.8 million from $52 million to $53.8 million.

UNTC Operating Revenues and Operating Costs (UNTC 2023 Q2 10-Q)

Risks

When recommending stocks the biggest influence I take into account is a companies' ability to weather adverse events concerning its general business climate. UNTC's impressive ability to repay its debt and therefore reduce its interest payments on any debt it may have to refinance in the future gives an enormous advantage to UNTC in these next few years of interest rate uncertainty. Its ability to clean up its balance sheet over the past few years is a key factor as to why I am recommending this stock as a buy but, UNTC is still subject to some industry wide uncertainty that could hamper investors' ability to realize gains from this undervalued stock. Like all oil producers, OPEC+'s ability to set and support production levels for oil greatly impacts global oil demand and pricing. Global oil and gas demand could also plummet if China's economic recovery continues to stagnate and plunges the rest of the world into a recession in which case UNTC could see a reduced demand for its drilling contracts and lower prices for its oil and natural gas business segments. The ongoing conflict between Russia and Ukraine may also throw curve balls at future global oil and natural gas prices that markets have not factored in yet.

Adverse climate effects in the United States can greatly influence demand for oil and natural gas as well. Uncharacteristic weather patterns could increase demand but may also reduce UNTC's ability to deliver its products and services to its customers. Large hurricane events can shut down off shore oil rigs and spike oil prices. Abnormally cold weather events can cause a surge in oil and natural gas demand uncharacteristic of normal seasonal forecasts and as we saw in 2022 warm winters can drastically shrink global demand for natural gas. While derivates contracts limit future losses in the event that oil and natural gas prices fall derivates contracts also limit UNTC's ability to realize dramatic spikes in oil and gas prices as well and acts as a sort of insurance policy against extreme pricing volatility.

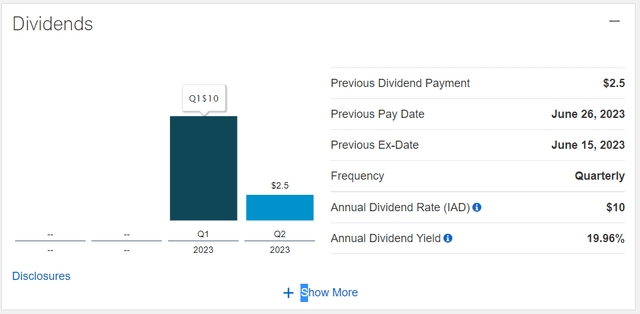

Special Dividend Payments

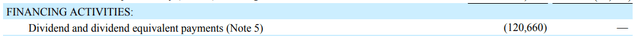

In January of 2023 UNTC announced and paid out a special cash dividend of $10.00 a share returning a total of $96.1 million to shareholders. On June 26th, they returned another $24.1 million to shareholders through a $2.50 dividend payment and as of August 10th, 2023 UNTC has approved two more $2.50 dividend payments, one in the third and the other in the fourth quarter of 2023, the exact payment dates have yet to be announced. This leaves UNTC with a current annual dividend yield of 19.96%. Should UNTC not follow through on future dividend payments or stock buybacks after posting 2024's 10-K I would strongly consider selling this stock especially if its stock price performance remains flat.

Dividend Payment total (UNTC 2023 Q2 10-Q)

UNTC Annual Dividend Yield (Charles Schwab UNTC Profile Page)

Stock Performance

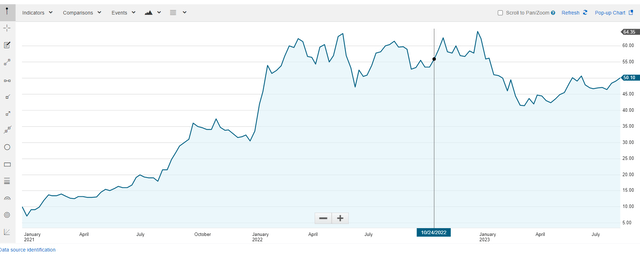

In June of 2021 UNTC began announcing it was buying back $25 million in outstanding common stock. Over the course of the next year Unit made two more announcements, one in October of 2021 increasing the buyback figure to $50 million, and one in June of 2022 further increasing UNTC's funds for stock buybacks all the way up to $100 million. This was accompanied by an impressive 165.5% increase in natural gas prices in 2021 and a 53% increase in natural gas prices in 2022 which helped propel UNTC's stock from under $10 in early 2021 a share to $64 in August of 2022.

UNTC's stock is currently experiencing a slump when compared to its 2022 performance. The stock had hit an all-time high at $65.75 in January 2023 shortly after the company announced its $10 special dividend payment and then slumped downwards hobbling around $40.00 until May of 2023 before beginning to shoot up again after the announcement of a $2.50 dividend payment in June 2023. You can see UNTC's stock price jumping sharply though briefly the week of August 10th after UNTC announced that it had approved two more $2.50 dividend payments, one in Q3 of 2023 and another in Q4 of 2023.

UNTC Stock Performance (Charles Schwab UNTC Profile)

The price of natural gas tanked dramatically in the second half of 2022 and the first half of 2023. Henry Hub natural gas prices were just over $9 per MMBtu in the middle of 2022 to $2.18 per MMBtu in June of 2023. Prices are expected to peak in 2023 at $3.44 per MMBtu in December and it does look like we have bottomed on natural gas prices as our supply chains readjust production and as the winter months of 2022 and 2023 had been abnormally warm reducing the need for natural gas consumption to heat homes. At the same time that natural gas prices appear to be stabilizing the price of a barrel of crude oil is rising.

This convergence of more stable natural gas prices, higher oil prices, and UNTC getting rid of a substantial portion of its oil and natural gas wells in 2022 before natural gas had bottomed so it can focus on the more stable segments of its business (drilling) should help UNTC's stock begin to trend upward again. This seems all the more likely knowing that UNTC still has a large pile of cash in its war chest for further buybacks and dividend payments and may be further interested in selling off more of its natural gas assets now that the sale of Superior Pipeline has gone through.

Peer Comparison

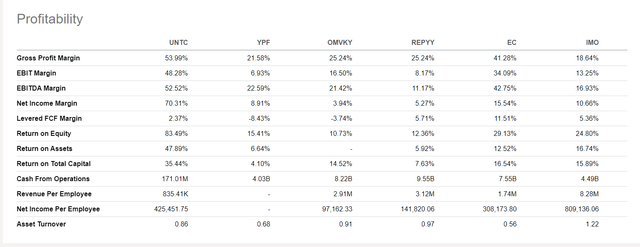

When compared to peers YPF Sociedad Anónima (YPF), OMV AG (OTCPK:OMVKY), Repsol S.A. ADR (OTCQX:REPYY), Ecopetrol S.A. (EC), and Imperial Oil Limited (IMO) on seeking alpha you can see UNTC's impressive earnings margins. A 47.9% return on assets compared to their peers' 5.9% to 16.7% range. A return on total capital of 35.4% as compared with peers' 4.1% to 16.5% range. An EBIT margin of 48.28% is also well above other comparable oil and gas peers with most others coming in between 6.9% and 34.1%. Gross profit margins and net income are therefore predictably higher as well with gross profit margins of 54% vs 18.6% to 41.2% and a net income margin way above their peers of 70.3% versus a 3.9% to 15.4% range.

Peer Comparison of Profitability (Seeking Alpha )

The extreme case of net income outpacing the rest of UNTC's peers by so much can be attributed to their massive sell off of property as well as entire businesses, but even so it is clear that UNTC has, by selling off unproductive or non-core assets and by paying off all of their debt, aligned themselves with a highly profitable low leveraged business model that has an open path to a more sustainably profitable future. These earnings margins offer in some sense a margin of safety to UNTC for in the event of an economic downturn. They have less of a chance of going belly up like many oil and gas companies did as a result of the 2014 - 2016 slump in oil prices. The ability to weather adverse events as just described while their peers go out of business would lead to UNTC absorbing a higher percentage of business in the oil and gas industry, clearing the way for future growth.

True Liquid Value Of UNTC Vs. Their Market Cap

If adverse business conditions become too great a risk for the company UNTC can just sell off the remainder of its businesses for a handsome profit. With a market cap of $473.5 million and current cash holdings of $199.8 million at the end of June 2023 UNTC should be able to sell the rest of its business segments for more than they're worth on paper. Patterson-UTI Energy (PTEN) bought 17 oil rigs from Pioneer Energy Services Corp. (OTC:PESX) in 2021, 16 of which were super spec rigs similar to UNTC's BOSS rigs. At the time day rates for the utilization of these oil rigs ran around $17,000 and these rigs were sold to Patterson-UTI Energy for $295 million. Day rates currently sit at $31,990 a day for UNTC's 14 Boss rigs and $22,981 a day for their SCR rigs. After subtracting UNTC's $199.8 million worth of cash from their market cap you have $273 million in market cap value left to account for. This is right in line with the value that would, based off of the Pioneer Energy Services Corp. transaction, be paid out if UNTC sold off the rest of their drilling fleet. This leaves UNTC's entire oil and gas business Unit Petroleum as pure profit for shareholders should UNTC liquidate itself and return its full value to shareholders.

Thesis For A Buy Rating

I believe for the reasons previously stated that UNTC is a buy. Its earnings from operations and cash from operations have both shown an impressive increase this year while UNTC simultaneously continues to slim down its business model to focus on Unit Drilling, its most stable business segment with the most predictable growth. It's cash holding are currently near record highs even with an impressive amount of dividend payments in 2023 and some stock buybacks in 2022 which should translate to future dividend payments and buybacks as UNTC further slims down its business. Oil prices and demand are currently surging and UNTC has good price leverage on their BOSS oil rigs which continue to consistently increase their day rates with ease. Leaving the Superior Pipeline business and shrinking their exposure to the oil and natural gas business while focusing on drilling lessens their risk to the more volatile parts of the fossil fuel industry and enables them to focus on sustainable long term growth.

While the Dividend payments and stock buybacks have been nice I do think that there is more to come from UNTC's massive $199.8 million pile of cash. Buybacks could ensure the stock retains its relative value while the company narrows its business interests and even with two more $2.50 dividends due before 2024, I believe UNTC will likely present another large special lump sum dividend payment early next year.

Reasons To Sell

Should UNTC not follow through on future dividend payments or stock buybacks after posting 2024's 10-K I would strongly consider selling this stock especially if its stock price performance remains flat. If you don't necessarily like dealing with the volatility that comes with the fossil fuel industry a good time to consider selling UNTC's stock in the future is after a stock price spike that may occur after UNTC announces other large dividend payments. While its stock should increase in price generally as natural gas prices improve and as oil prices continue to rise an excellent exit point may be created sometime early in 2024 as UNTC looks over their annual figures and historically makes large and exciting announcements to its shareholders. UNTC has enough available cash on hand to issue another $10.00 dividend payment and the stock shot up past $65.00 after UNTC announced the previous $10.00 dividend payment. If UNTC's current stock price of $49.90 shot up to $65.00 shareholders buying in at today's price would realize a 30.3% gain on top of a current annual dividend yield of 19.96%.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

"corp" - Google News

September 04, 2023 at 01:37PM

https://ift.tt/7hP09uB

Unit Corp: Small Company With Tons of Cash And Big Dividends (OTCMKTS:UNTC) - Seeking Alpha

"corp" - Google News

https://ift.tt/U9ei0xX

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Unit Corp: Small Company With Tons of Cash And Big Dividends (OTCMKTS:UNTC) - Seeking Alpha"

Post a Comment