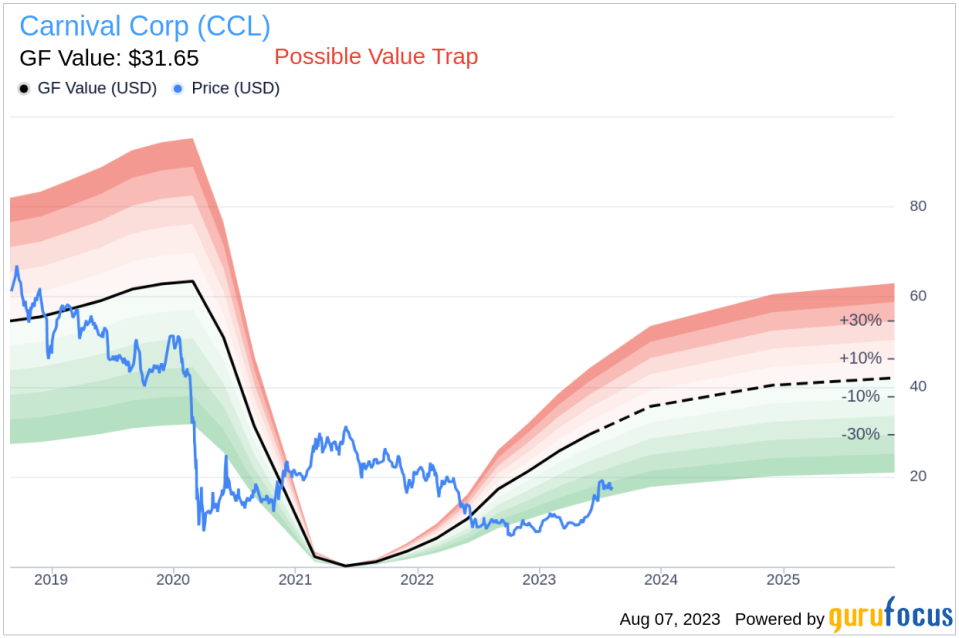

Value investors are always on the hunt for stocks trading below their intrinsic value. One such intriguing prospect is Carnival Corp (NYSE:CCL), currently priced at $17.85. Despite a day's gain of 4.02% and a 3-month gain of 76.07%, the stock's Fair Value (GF Value) stands at $31.65. However, a comprehensive analysis reveals potential risks associated with Carnival (NYSE:CCL), as indicated by its low Altman Z-score. This intricate scenario suggests that Carnival could be a potential value trap.

Understanding the Altman Z-Score

The Altman Z-score is a financial model developed by New York University Professor Edward I. Altman in 1968. It predicts the likelihood of a company entering bankruptcy within two years. The Altman Z-Score combines five different financial ratios, each with a specific weightage, to create a final score. A score below 1.8 suggests a high risk of financial distress, while a score above 3 indicates a low risk.

An Overview of Carnival Corp (NYSE:CCL)

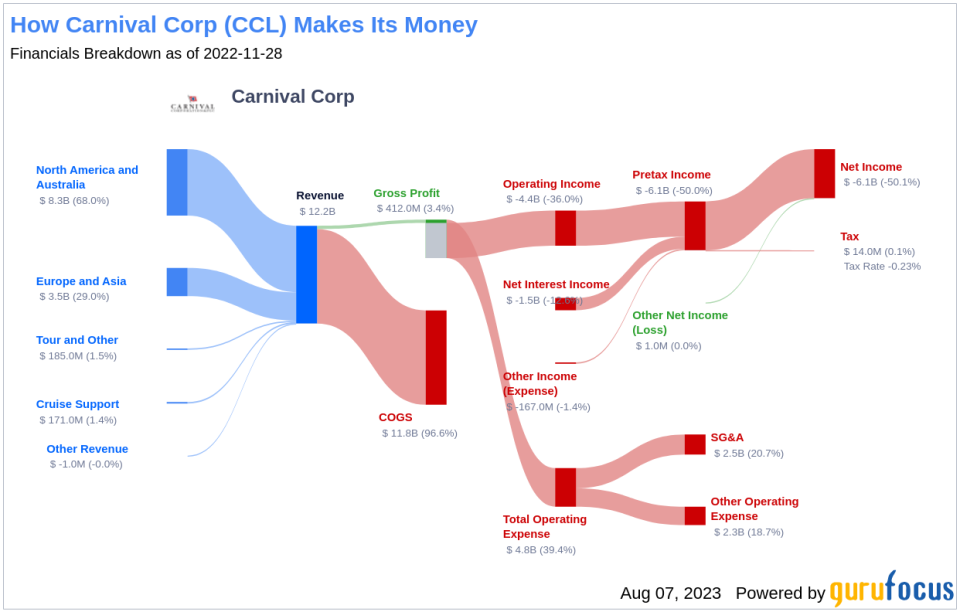

Carnival is the largest global cruise company, boasting a fleet of 90 ships in service at the end of fiscal 2022. Its portfolio includes renowned brands like Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe; and P&O Cruises in Australia. Carnival also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Prior to the COVID-19 pandemic, Carnival's brands attracted about 13 million guests in 2019, a level it should breach again in 2023.

Decoding Carnival's Low Altman Z-Score

A closer look at Carnival's Altman Z-score reveals potential financial distress. The Retained Earnings to Total Assets ratio, a key determinant of a company's ability to reinvest profits or manage debt, shows a declining trend for Carnival. Historical data from 2020 to 2023 indicates a decrease in this ratio from 0.43 to -0.02. This downward movement suggests Carnival's diminishing ability to reinvest in its business or manage its debt effectively, exerting a negative impact on its Z-Score.

Conclusion: Navigating the Value Trap

Despite Carnival's seemingly attractive price, its low Altman Z-Score and declining Retained Earnings to Total Assets ratio raise concerns about its financial health. These indicators suggest that Carnival may be a value trap rather than a bargain. It serves as a reminder for investors to delve deeper into financial metrics and not base decisions solely on apparent undervaluation.

GuruFocus Premium members can find stocks with high Altman Z-Score using the Walter Schloss Screen.

This article first appeared on GuruFocus.

"corp" - Google News

August 07, 2023 at 11:32PM

https://ift.tt/cBMYhIv

Dissecting the Value Trap: A Deep Dive into Carnival Corp (CCL) - Yahoo Finance

"corp" - Google News

https://ift.tt/ZIvpMfA

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Dissecting the Value Trap: A Deep Dive into Carnival Corp (CCL) - Yahoo Finance"

Post a Comment